November 17, 2022

FOR DISTRIBUTION

BOARD OF DIRECTORS AND SHAREHOLDERS

QUANTUM COMPUTING, INC.

215 DEPOT COURT

LEESBURG, VA 20175

FOR DISTRIBUTION

BOARD OF DIRECTORS AND SHAREHOLDERS

QUANTUM COMPUTING, INC.

215 DEPOT COURT

LEESBURG, VA 20175

Dear Members of the Board and Shareholders:

BV Advisory Partners, LLC (together with its affiliates, “BVP” or “we”)* are stakeholders** of Quantum Computing, Inc. (Nasdaq: QUBT) (the “Company”, “QUBT” or “QCI”).

* BVP was a [financial advisor] to QPhoton, Inc., a Delaware company, (“QPhoton “) who was acquired by QUBT on June 16, 2022 in a merger (the “Merger”) pursuant to an Agreement and Plan of Merger, dated May 18, 2022 by and among, QUBT, two of its wholly-owned subsidiaries, QPhoton and Yuping Huang, the former Chairman. Chief Executive Officer, President and, together with his wife, Xiao Pan, who also was a QPhoton director, who claims to be the holder of more than 80% of the outstanding QPhoton common stock; and since the Merger closing has been the Chief Quantum Officer, a director and the largest shareholder of QUBT. BVP also was at least a 10% stockholder of QPhoton, introduced and arranged the license by QPhoton of all of its quantum intellectual property from the Stevens Institute, provided the initial $500,000 of funding to QPhoton through the purchase of $500,000 QPhoton convertible notes (the “Notes”), assisted in the building of QPhoton into an operational company, and introduced QPhoton to QUBT. Because BVP did not receive any cash compensation for its 18 months of services to QPhoton and for the risks taken by BVP in providing the $500,000 of initial financing to QPhoton, at a time when QPhoton had no funds, revenues and/or any other prospects or sources of funding, QPhoton agreed in the Notes and the Note Purchase Agreement with BVP dated March 1, 2021 (the “NPA”) that upon the closing of the Merger (a change of control), BVP would receive as payment for its Notes a dollar amount equal to the market value of the number of shares of QUBT common stock BVP would receive as if it converted its Notes into QPhoton common stock, as adjusted based upon an arms-length negotiated formula between QPhoton and BVP including as to the conversion price, immediately prior to the Merger, which payment amount as of the date of Merger closing was $13,182,140 million. Because BVP believes QPhoton and QUBT breached their payment obligations under the Notes and the NPA, on August 15, 2022, BVP sued QPhoton, QUBT and its executive officers Robert Liscouski, CEO and Director, William McGann, COO and CTO and Chris Roberts CFO as well as Greg Osborne, the Director of Business Development of QUBT, Joseph Salvani, who BVP believes based upon, among other factors, correspondences with QUBT and representations by Salvani and others, that Salvani is an undisclosed “founder,” principal and control person of QUBT, and Dan Walsh, identified in QUBT correspondence to BVP as Salvani’s “partner (cap markets).” In prior actions brought by the SEC against Salvani, Osborne, such persons were sanctioned by the SEC for violations of the United States Federal Securities Laws. See https://www.sec.gov/litigation/admin/34-44590.htm (cited as: Joseph M. Salvani, Exchange Act Release No. 44590 (July 26, 2001)) and https://www.sec.gov/litigation/opinions/2019/33-10641.pdf (cited as: Gregory Osborn, Securities

Act Release No. 10641, Exchange Act Release No. 86001, Investment Company Act Release No. 33498, 2019 WL 2324337 (May 31, 2019)). BVP’s Verified Complaint, captioned, BV Advisory Partners, LLC, (Plaintiff) v. Quantum Computing Inc., QPhoton, LLC, Yuping Huang, Xiao Pan, Robert Liscouski, William McGann, Chris Roberts, Joseph Michael Salvani, Gregory Osborn, and Dan Walsh, (Defendants), C.A. No. 2022-0719-SG (Del. Ch. filed on Aug. 15, 2022). A copy of the complaint is attached hereto as Exhibit A.

** Because of BVP’s concerns regarding and the actions of QUBT including its management and the QUBT Board as set forth in this letter and in BVP’s litigation complaint, BV has demanded its appraisal rights with regard to its QPhoton stock.

We are writing to express our views that the cost base of QCI is too high and that management needs to immediately take aggressive action. The company has too many overpriced executives and consultants who generate no revenue and needs to cut costs immediately! Management should publicly disclose an EBIT margin target and host a conference call for all stakeholders to question the board and management.

In your most recently reported 3Q 2022, total expenses and net income losses grew ~50% year-over-year to over ~$7.5million while total revenues grew to only ~$37,000. The Account Receivables very shockingly continues to grow resulting in QCI having a negative gross margin and negative EBIT margin. Do you have any accounting issues or are you even getting paid for the revenue you are reporting? After reviewing your most recently filed 3Q financials we have questions compared to your direct competitor IONQ who also just reported. Our question for this board and all shareholders based on the most recently reported financials, is do you think the leadership and performance of the QCI management team is worth the staggering compensation that they are sucking out of the company based on the below

recently reported metrics? This management team has decided to take on ~$8.5million of toxic debt, spend ~$2.2million in legal fees in this quarter instead of paying an investor what we are owed! This company has accumulated over ($101million in losses with the current leadership for just ~$134,000 in revenue in four years.) Meta, Microsoft, Amazon, Google and IBM have all announced spending cuts and layoffs, but this management team continues to increase their compensation with shareholders money without any clear path to a sustainable business model. Given the lack of transparency, these troubling financials, the network of bad actors surrounding the company, and the recent news and similar behavior of FTX collapse, we are calling for an immediate freeze on all spending, an outside committee to be formed (to include an appointee from our group) to investigate, re-audit all financials, and evaluate whether to replace the entire board and management team to protect all stakeholders. As of November 11, 2022 QCI had only ~$7.1million of working capital and is burning ~$2million in cash per month, so time is running out before this management team will have to do another dilutive toxic financing to continue to pay themselves for poor performance!

QUBT 3Q Highlights:

IONQ 3Q Highlights:

Headcount is too high:

Our conversations with a former executive and employees suggest that the business could be operated more effectively with significantly fewer employees and consultants.

Compensation per employee is too high

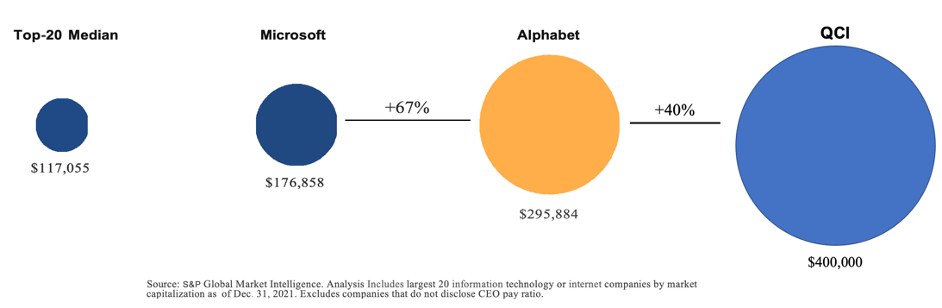

QCI pays some of the highest salaries to its senior management compared to bigger and more profitable technology companies in Silicon Valley (but you are based in Leesburg, VA.) As detailed in your recent filings, the median compensation to QCI’s senior management team averages ~$400,000 in 2022 (with Dr.Yuping Huang being the ONLY member having any quantum expertise.) An analysis of publicly trade technology companies illustrates that median compensation at QCI was 127% higher than at Microsoft and 170% higher than the 20 largest listed technology companies in the US. There is no justification for this enormous disparity, as both Microsoft and Google have a bigger presence in Quantum than QCI.

We acknowledge that QCI may employ some talented engineers, but they represent only a fraction of the employee compensation cost. Outside of Dr. Yuping Huang the majority of senior management and consultants are performing general sales, marketing and administrative jobs, who have only generated ~$134,000 in revenue since 2018 versus a year to date accumulated deficit of (-$101 million in losses.)

BV Advisory Partners, LLC (together with its affiliates, “BVP” or “we”)* are stakeholders** of Quantum Computing, Inc. (Nasdaq: QUBT) (the “Company”, “QUBT” or “QCI”).

* BVP was a [financial advisor] to QPhoton, Inc., a Delaware company, (“QPhoton “) who was acquired by QUBT on June 16, 2022 in a merger (the “Merger”) pursuant to an Agreement and Plan of Merger, dated May 18, 2022 by and among, QUBT, two of its wholly-owned subsidiaries, QPhoton and Yuping Huang, the former Chairman. Chief Executive Officer, President and, together with his wife, Xiao Pan, who also was a QPhoton director, who claims to be the holder of more than 80% of the outstanding QPhoton common stock; and since the Merger closing has been the Chief Quantum Officer, a director and the largest shareholder of QUBT. BVP also was at least a 10% stockholder of QPhoton, introduced and arranged the license by QPhoton of all of its quantum intellectual property from the Stevens Institute, provided the initial $500,000 of funding to QPhoton through the purchase of $500,000 QPhoton convertible notes (the “Notes”), assisted in the building of QPhoton into an operational company, and introduced QPhoton to QUBT. Because BVP did not receive any cash compensation for its 18 months of services to QPhoton and for the risks taken by BVP in providing the $500,000 of initial financing to QPhoton, at a time when QPhoton had no funds, revenues and/or any other prospects or sources of funding, QPhoton agreed in the Notes and the Note Purchase Agreement with BVP dated March 1, 2021 (the “NPA”) that upon the closing of the Merger (a change of control), BVP would receive as payment for its Notes a dollar amount equal to the market value of the number of shares of QUBT common stock BVP would receive as if it converted its Notes into QPhoton common stock, as adjusted based upon an arms-length negotiated formula between QPhoton and BVP including as to the conversion price, immediately prior to the Merger, which payment amount as of the date of Merger closing was $13,182,140 million. Because BVP believes QPhoton and QUBT breached their payment obligations under the Notes and the NPA, on August 15, 2022, BVP sued QPhoton, QUBT and its executive officers Robert Liscouski, CEO and Director, William McGann, COO and CTO and Chris Roberts CFO as well as Greg Osborne, the Director of Business Development of QUBT, Joseph Salvani, who BVP believes based upon, among other factors, correspondences with QUBT and representations by Salvani and others, that Salvani is an undisclosed “founder,” principal and control person of QUBT, and Dan Walsh, identified in QUBT correspondence to BVP as Salvani’s “partner (cap markets).” In prior actions brought by the SEC against Salvani, Osborne, such persons were sanctioned by the SEC for violations of the United States Federal Securities Laws. See https://www.sec.gov/litigation/admin/34-44590.htm (cited as: Joseph M. Salvani, Exchange Act Release No. 44590 (July 26, 2001)) and https://www.sec.gov/litigation/opinions/2019/33-10641.pdf (cited as: Gregory Osborn, Securities

Act Release No. 10641, Exchange Act Release No. 86001, Investment Company Act Release No. 33498, 2019 WL 2324337 (May 31, 2019)). BVP’s Verified Complaint, captioned, BV Advisory Partners, LLC, (Plaintiff) v. Quantum Computing Inc., QPhoton, LLC, Yuping Huang, Xiao Pan, Robert Liscouski, William McGann, Chris Roberts, Joseph Michael Salvani, Gregory Osborn, and Dan Walsh, (Defendants), C.A. No. 2022-0719-SG (Del. Ch. filed on Aug. 15, 2022). A copy of the complaint is attached hereto as Exhibit A.

** Because of BVP’s concerns regarding and the actions of QUBT including its management and the QUBT Board as set forth in this letter and in BVP’s litigation complaint, BV has demanded its appraisal rights with regard to its QPhoton stock.

We are writing to express our views that the cost base of QCI is too high and that management needs to immediately take aggressive action. The company has too many overpriced executives and consultants who generate no revenue and needs to cut costs immediately! Management should publicly disclose an EBIT margin target and host a conference call for all stakeholders to question the board and management.

In your most recently reported 3Q 2022, total expenses and net income losses grew ~50% year-over-year to over ~$7.5million while total revenues grew to only ~$37,000. The Account Receivables very shockingly continues to grow resulting in QCI having a negative gross margin and negative EBIT margin. Do you have any accounting issues or are you even getting paid for the revenue you are reporting? After reviewing your most recently filed 3Q financials we have questions compared to your direct competitor IONQ who also just reported. Our question for this board and all shareholders based on the most recently reported financials, is do you think the leadership and performance of the QCI management team is worth the staggering compensation that they are sucking out of the company based on the below

recently reported metrics? This management team has decided to take on ~$8.5million of toxic debt, spend ~$2.2million in legal fees in this quarter instead of paying an investor what we are owed! This company has accumulated over ($101million in losses with the current leadership for just ~$134,000 in revenue in four years.) Meta, Microsoft, Amazon, Google and IBM have all announced spending cuts and layoffs, but this management team continues to increase their compensation with shareholders money without any clear path to a sustainable business model. Given the lack of transparency, these troubling financials, the network of bad actors surrounding the company, and the recent news and similar behavior of FTX collapse, we are calling for an immediate freeze on all spending, an outside committee to be formed (to include an appointee from our group) to investigate, re-audit all financials, and evaluate whether to replace the entire board and management team to protect all stakeholders. As of November 11, 2022 QCI had only ~$7.1million of working capital and is burning ~$2million in cash per month, so time is running out before this management team will have to do another dilutive toxic financing to continue to pay themselves for poor performance!

QUBT 3Q Highlights:

- Only $37,646 in consulting revenue versus (-$297,107 in consulting expenses) your account receivables have increased to $94,807 (Are you getting paid for any revenue?)

- $1,596,694million in salaries and consulting fees.

- $2.2 million in Legal Fees

- $2,721,596 in SG&A

- $7,569,278 Net Loss

- Cash as of Nov. 11, 2022: $8.5million ( But only $7.1million of Working Capital)

- $8.5million in Debt coming next year with $750,000 payment coming due in Feb

- No Investor conference call to allow an open forum to question these concerning financials

IONQ 3Q Highlights:

- $2.8 million in Revenue and $16.4million in new customer bookings.

- Full year Revenue projects $10.2 to $10.7million in revenue and $23 to $27million in new customer bookings.

- New Customers and Partnerships with a $13.4million contract with the Air Force, DOE, and new Joint Venture Partnership with Dell Technologies.

- $555million in Cash on hand

- 3Q conference call was held on Nov.14, 2022

Headcount is too high:

Our conversations with a former executive and employees suggest that the business could be operated more effectively with significantly fewer employees and consultants.

Compensation per employee is too high

QCI pays some of the highest salaries to its senior management compared to bigger and more profitable technology companies in Silicon Valley (but you are based in Leesburg, VA.) As detailed in your recent filings, the median compensation to QCI’s senior management team averages ~$400,000 in 2022 (with Dr.Yuping Huang being the ONLY member having any quantum expertise.) An analysis of publicly trade technology companies illustrates that median compensation at QCI was 127% higher than at Microsoft and 170% higher than the 20 largest listed technology companies in the US. There is no justification for this enormous disparity, as both Microsoft and Google have a bigger presence in Quantum than QCI.

We acknowledge that QCI may employ some talented engineers, but they represent only a fraction of the employee compensation cost. Outside of Dr. Yuping Huang the majority of senior management and consultants are performing general sales, marketing and administrative jobs, who have only generated ~$134,000 in revenue since 2018 versus a year to date accumulated deficit of (-$101 million in losses.)

Median Compensation At Largest Us Technology Companies

Establish an EBIT margin target & Report Bookings

As part of basic financial management, QCI should establish and publicly disclose an EBIT margin target for the company. We believe an EBIT margin target of at least ~35% is reasonable. Management should like the majority of it’s competitors report bookings, and breakout in detail who your customers are by revenue. Management compensation should be linked to this EBIT target to ensure accountability.

Summary

In a new era of slower revenue growth and limited access to traditional capital, aggressive cost management is essential to the survival of the company. Stop doing toxic financings with SEC sanctioned bad actors to pay yourselves! The entire Senior Management team needs to immediately reduce your salaries by at least~75%. Despite being granted and paid millions of dollars in cash and stock grants NO ONE from the board, senior management, nor the many consultants you have paid have EVER purchased with their own money any shares of the company in the open market. Given that QCI stock has gone from $20 to $2 per share why haven’t you re-invested the money you all have sucked out of the company back into the company? An outside investigation needs to be launched to confirm if anyone from the board, senior management, and ALL consultants who have been granted shares, options or warrants have ever sold any QCI granted shares. Cost discipline is now required as a sustainable business model can’t be achieved by this current board and management team. Cost growth above revenue growth is a sign of poor financial discipline. We look forward to your announcement of a clear action plan as a matter of urgency.

Yours sincerely,

As part of basic financial management, QCI should establish and publicly disclose an EBIT margin target for the company. We believe an EBIT margin target of at least ~35% is reasonable. Management should like the majority of it’s competitors report bookings, and breakout in detail who your customers are by revenue. Management compensation should be linked to this EBIT target to ensure accountability.

Summary

In a new era of slower revenue growth and limited access to traditional capital, aggressive cost management is essential to the survival of the company. Stop doing toxic financings with SEC sanctioned bad actors to pay yourselves! The entire Senior Management team needs to immediately reduce your salaries by at least~75%. Despite being granted and paid millions of dollars in cash and stock grants NO ONE from the board, senior management, nor the many consultants you have paid have EVER purchased with their own money any shares of the company in the open market. Given that QCI stock has gone from $20 to $2 per share why haven’t you re-invested the money you all have sucked out of the company back into the company? An outside investigation needs to be launched to confirm if anyone from the board, senior management, and ALL consultants who have been granted shares, options or warrants have ever sold any QCI granted shares. Cost discipline is now required as a sustainable business model can’t be achieved by this current board and management team. Cost growth above revenue growth is a sign of poor financial discipline. We look forward to your announcement of a clear action plan as a matter of urgency.

Yours sincerely,

Keith Barksdale

Managing Member

Managing Member